How Credit Unions Can Unlock Hidden Opportunities in Employer Benefits

by Andy Kalmon

Dec 6, 2024

How Credit Unions Can Unlock Hidden Opportunities in Employer Benefits

In today’s competitive financial services landscape, credit unions are uniquely positioned to deliver personalized financial solutions. However, standing out from the crowd and attracting younger, high-income members remains a persistent challenge. For executives—CEOs and COOs of credit unions in particular—the stakes are high: differentiating their institutions, addressing aging membership bases, and ensuring ROI on strategic initiatives are critical for sustained growth.

One untapped area that holds immense potential for credit unions is employer benefits, specifically Employee Stock Purchase Plans (ESPPs). These benefits, often misunderstood and underutilized, offer a pathway for credit unions to engage new members, deepen existing relationships, and drive measurable returns.

The Membership Growth Challenge

Credit unions excel at fostering community and trust, yet many face a critical hurdle: an aging membership base. Younger professionals—especially those employed at public companies—demand financial solutions that align with their fast-paced, tech-driven lives. They value tools that simplify complex decisions, such as managing employer benefits, and want a seamless digital experience.

The key to winning their business lies in becoming a trusted partner in their financial journey. ESPPs are a powerful gateway to achieving this goal.

What Are ESPPs, and Why Do They Matter?

An ESPP allows employees of public companies to purchase their employer’s stock at a discounted rate, often up to 15%. For participants, this is a low-risk way to build wealth. For credit unions, this is an opportunity to provide members with access to funding that helps them maximize their benefits.

However, many employees are hesitant to participate in ESPPs due to cash flow concerns or lack of awareness about the potential returns. This is where credit unions can step in, positioning themselves as enablers of financial growth.

Unlocking Hidden Opportunities with ESPP Funding

Credit unions can leverage ESPP funding solutions to:

Attract More Gen-Z & Millenial, High-Income Members:

Employees at public companies often fall into a younger, tech-savvy demographic with significant earning potential. By offering tailored ESPP funding solutions, credit unions can meet their needs while building relationships that last.Drive ROI Through Strategic Lending:

Offering ESPP-related loans or lines of credit allows credit unions to diversify their lending portfolio. These loans are low-risk, as they are backed by the stock purchase itself, and often generate impressive returns.Differentiate in a Crowded Market:

By providing innovative, benefit-backed lending solutions, credit unions can stand out as forward-thinking and member-focused, attracting both individual members and employer partnerships.

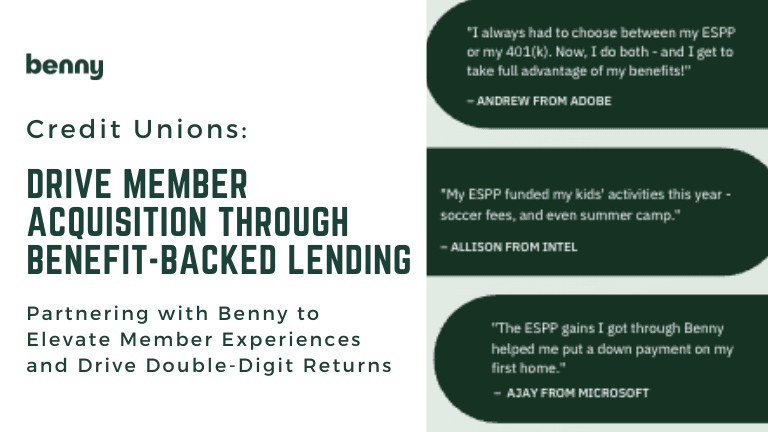

The Strategic Advantage of Partnering with Benny

Benny is a platform that empowers financial institutions to tap into the untapped potential of ESPPs. By integrating Benny’s solutions, credit unions can offer members a $3K "raise"! Benny’s ESPP platform has delivered over $350K in gains for more than two hundred employees.

How does it work? Lynne's story:

Lynne, a mid-level employee at Intel earning $113K annually, wanted to participate in her money-making ESPP but was held back by everyday expenses. With Benny’s support, Lynne’s story took a turn for the better. Benny provided her with the cash she needed to fully participate in her Employee Stock Purchase Plan (ESPP), allowing her to unlock the financial potential she had been missing. Without Benny, Lynne might have remained on the sidelines, unable to maximize the money-making opportunity her ESPP offers.

With Benny

Lynne borrowed $8.5K to purchase discounted company shares over six months.

At the end of the six-month ESPP cycle, Intel bought shares worth $10K (because of the discount enabled by the ESPP), netting her a $1.5K profit.

Lynne and others like her repeat this process every six months, showcasing the scalability and success of Benny’s platform.

Positioning Your Credit Union for the Future

As credit union leaders, you have a critical decision to make: will your institution continue to compete on traditional offerings, or will you embrace innovative partnerships to differentiate and grow?

Benny has been supporting employees since 2021 with an ESPP platform that offers strategy, optimization, and funding. Now, we’re looking for a partner who cares as much as we do about helping these employees and is able to lend us their lending capabilities.

Unlocking the potential of employer benefits through ESPP funding is more than a strategic move—it’s a transformative opportunity. With Benny as a partner, your credit union can address the needs of younger, high-income professionals, stand out in a crowded market, and achieve the ROI-driven results you’re seeking.

Ready to explore what’s possible? Let’s talk about how Benny can help your credit union unlock hidden opportunities in employer benefits.